Open now opens in same window

Account subject to approval

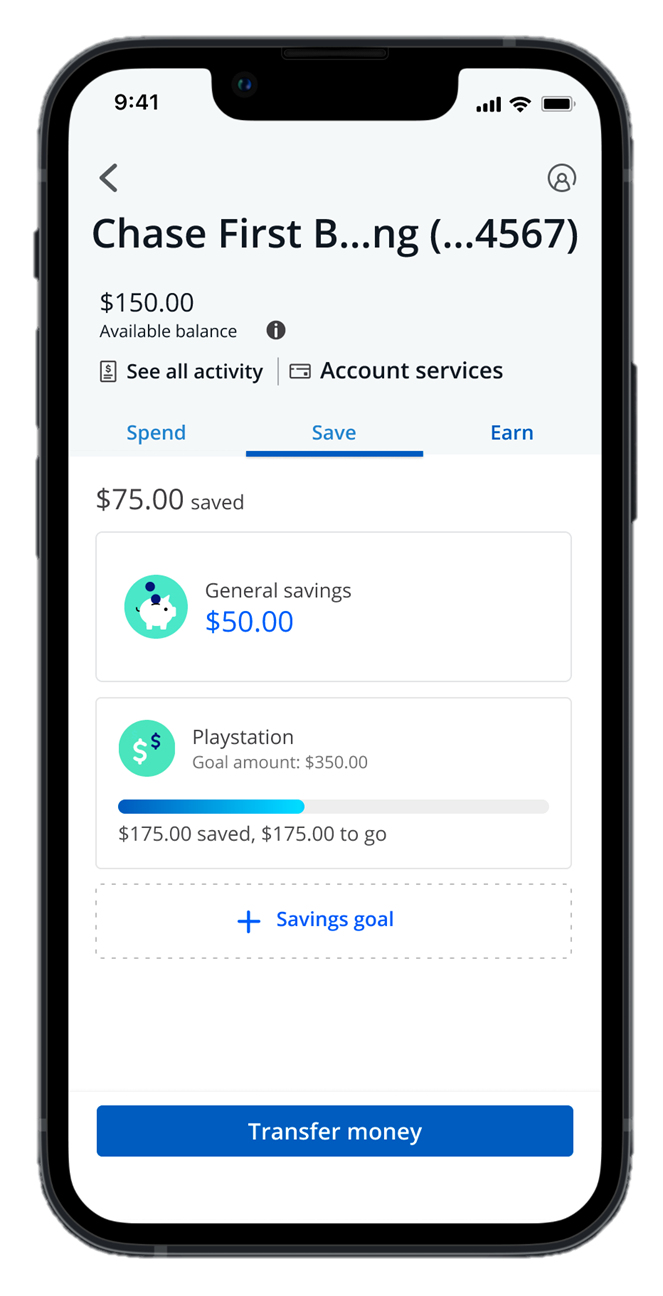

Their card, your guidance. With Chase First Banking, your kids will be on the path to learning financial responsibility.

Set limits on where and how much they can spend or withdraw from ATMs. Plus, Account Alerts Same page link to footnote reference 2 help you keep track of their purchases.

Teach your kids money skills with confidence using security features like secure sign-in via the Chase Mobile ® app. Same page link to footnote reference 3

“ It is very cool to have my own debit card with my name and then I can pay for my own things without my parents' card. ”

“ I really love that I am able to start teaching my child about banking, saving, earning, and spending. ”

Participants are compensated for their survey participation.

From the first day of school to college graduation, Chase meets your student where they are in their financial journey:

Plus, set them up with a Chase Savings SM Opens in a new window account to start building healthy saving habits.

Open a Chase First Banking account for your children

Choose the checking account that’s right for you

Chase First Banking is a banking account for kids opened by parents that helps families digitally manage spending and provides opportunities for kids to learn and practice the basics of personal finance by using a debit card in their name. It can be accessed virtually anywhere with the Chase Mobile ® app Same page link to footnote reference 3 or on chase.com.

Chase First Banking accounts come with a number of unique features for both parents and kids.

Parents can:

Chase First Banking is available for kids ages 6-17 and designed with kids ages 6-12 in mind.

No, Chase First Banking does not have a direct deposit option. Chase High School Checking, an account for teens ages 13-17 that includes direct deposit and check writing, may be a better option. To learn more, visit Chase High School Checking SM Opens in a new window .

You need to be a Chase checking customer to open a Chase First Banking account. Chase First Banking accounts must be linked to a qualifying Chase checking account.

Anyone can open an account online or schedule a meeting Opens in a new window at a Chase branch. If you are a current Chase customer, you can also use your Chase Mobile ® app to open an account today. Need help deciding? Compare our checking account options here Opens in a new window .

No, Chase First Banking does not support peer-to-peer transactions like those using Zelle ® , Venmo ® , PayPal ® or Cash App TM . Additionally, the account’s debit card cannot be added to fund these types of transactions.

Same page link returns to footnote reference 1 For parents/guardians interested in teaching their child how to manage money using a debit card with the child's name on it. The parent/guardian is the owner of this account and must have an online profile and one of these other checking accounts at account opening: a Chase Secure Checking SM , Chase Total Checking ® , Chase Premier Plus Checking SM , Chase Sapphire SM Checking, or a Chase Private Client Checking SM account. Benefits offered to these checking accounts do not apply to Chase First Checking accounts. To promote parental controls and guardrails, only the parent/guardian who opened the account can fund or manage it. You can open a Chase First Checking account for your child who is 6 - 17 years old. Once the child has reached the age of 18, Chase may recommend they open their own account.

Same page link returns to footnote reference 2 Account Alerts: There's no charge from Chase, but message and data rates may apply. Delivery of alerts may be delayed for various reasons, including service outages affecting your phone, wireless or internet provider; technology failures; and system capacity limitations. Any time you review your balance, keep in mind it may not reflect all transactions including recent debit card transactions.

Same page link returns to footnote reference 3 Chase Mobile ® app is available for select mobile devices. Message and data rates may apply.

Same page link returns to footnote reference 4 The testimonials on this page or provided via linked videos are the sole opinions, findings or experiences of our customers and not those of JPMorgan Chase Bank, N.A. or any of its affiliates. These opinions, findings, or experiences may not be representative of what all customers may achieve. JPMorgan Chase Bank, N.A. or any of its affiliates are not liable for decisions made or actions taken in reliance on any of the testimonial information provided.

Same page link returns to footnote reference 5 Enrollment in Zelle ® with a U.S. checking or savings account is required to use the service. Chase customers must use an eligible Chase consumer or business checking account, which may have its own account fees. Consult your account agreement. To send money to or receive money from a small business, both parties must be enrolled with Zelle ® directly through their financial institution's online or mobile app experience. Funds are typically made available in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle ® (go to enroll.zellepay.com to view participating banks). Select transactions could take up to 3 business days. Enroll on the Chase Mobile ® app or Chase Online SM . Limitations may apply. Message and data rates may apply.

Zelle ® is intended for payments to recipients you know and trust and is not intended for the purchase of goods from retailers, online marketplaces or through social media posts. Neither Zelle ® nor Chase provide protection if you make a purchase of goods using Zelle ® and then do not receive them or receive them damaged or not as described or expected. In case of errors or questions about your electronic funds transfers, including information on reimbursement for fraudulent Zelle ® payments, see your account agreement. Neither Chase nor Zelle ® offers reimbursement for authorized payments you make using Zelle ® , except for a limited reimbursement program that applies for certain imposter scams where you sent money with Zelle ® . This reimbursement program is not required by law and may be modified or discontinued at any time.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.